Form 990 provides proof of impact

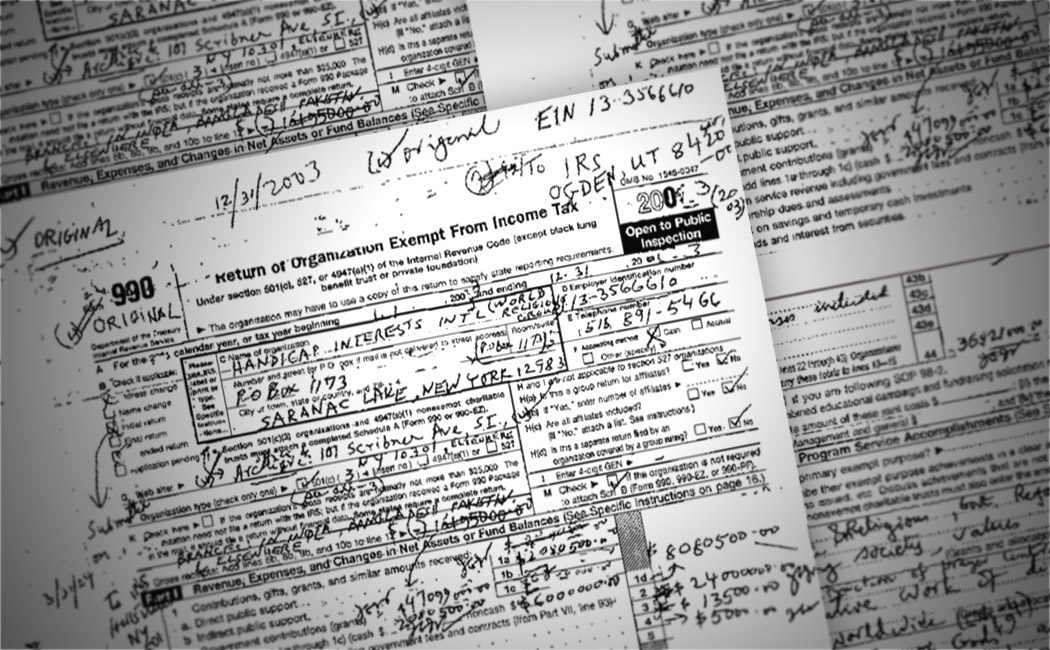

Not long ago, few people outside the Internal Revenue Service paid much attention to its Form 990. These days, savvy donors scrutinize “Return of Organization Exempt from Income Tax” forms to determine where they want to put their money.

“It went in an IRS black hole. Now it’s everywhere,” said Rena Coughlin, CEO of the Nonprofit Center of Northeast Florida. “The 990 is the only shared instrument that every nonprofit that is a 501(c)(3) has in common. So they have to be very conscious about how they interpret and report on their impact.”

The daunting 12-page, 12-section form that provides the public with financial information about a nonprofit is not something to be filled out on deadline or in an afternoon. It begins by requesting a brief description of the organization’s mission and ends with asking the accounting methods used for financial statements and reporting. Directives and questions in between include: List all the organization’s current key employees. And, did the organization have a written whistleblower policy?

“If you don’t have an accountant, you are probably filling it out wrong,” said Coughlin.

“If the IRS doesn’t like how it’s completed they can send it back, with severe penalties and interest,” said the Nonprofit Center’s auditor, Bill Abare of Kresge Platt & Abare, CPA. “As a nonprofit, your biggest asset is your name and the good that comes with it. “

Abare described Form 990 as an important and readily accessible document that provides financial and non-financial information about a nonprofit entity, including how many dollars go into programs as opposed to fundraising.

Nonprofits that make less than $50,000 in revenue—to be put back into programs—file a shorter form, a postcard 990.

“It could be that a nonprofit is doing good things but if they don’t take time to explain that, the numbers could look like everything is going to administration or fundraising, when this could be a fundraising year,” said Shannon Lashley-Richardson, Nonprofit Center accountant. “Sometimes donors get too caught up in program versus administrative expenses. The value of the 990 comes in when nonprofits explain what their programs are and the numbers back it up.”

If you don’t have an accountant, you

are probably filling it out wrong.

— Rena Coughlin, CEO of the Nonprofit Center of Northeast Florida

An advantage of being thorough is that Form 990 is public information that most nonprofits link to their websites. “They really do have to have it professionally presented,” Lashley-Richardson said. “It’s the financial face of their organization.”

Though helpful, Form 990 lacks reporting standards that would be useful for potential donors to compare organizations, Coughlin said.

“The next step is for the IRS and nonprofits to work together to create standard definitions for these broad categories that have become ways to judge nonprofits,” Coughlin said. “Nonprofits have stepped into the void. GuideStar helps from the accountability side and the sustainability side.”

Form 990 for all 1.7 million IRS-registered nonprofit organizations can be found online at GuideStar, a 501(c)(3) public charity itself that collects, organizes and presents the information at no cost. In addition to their Form 990, nonprofits are able to add data to the site, said Gabe Cohen, director of communications who works at GuideStar’s Washington, D.C., office. He spoke at NonprofitWorks 2016, a conference hosted by the Nonprofit Center in Jacksonville in June.

“Donors historically look at overhead ratio, but that is changing,” Cohen said. “Now they are looking for evidence of how organizations are making a difference in the world.”

But because Form 990 does not clearly ask those questions or show true evidence of results, funders often look to GuideStar and other sources for that information, Cohen said.

Largely because of inconsistencies in filling out Form 990, it is just a first step in making funding decisions for the Riverside Hospital Foundation, according to Helen Werking, executive director. She said the form is valuable in determining whether an organization is a 501(c)(3) and by providing a financial snapshot.

Werking said directors of the foundation, which provides financial assistance to corporations, organizations and programs that offer healthcare services in Northeast Florida, look closely at potential recipients’ missions, goals and objectives. She refers directors to “How to Assess Nonprofit Financial Performance,” a joint report by Northwestern and Harvard universities that contains questions to help funders probe into nonprofits’ missions, service delivery and financial health.

Still, it often comes down to human emotion.

“I think many donors respond emotionally to some mission they feel touches their heart,” Werking said.